This post was written on the day I lost my dearest Mam and so may not be quite up to my usual efforts but as the saying goes, time and chance happeneth to all so here it is.

It was over 200 years that U.S. colonists proclaimed ‘No taxation without representation’ but whether you live in a country with representation or not, no form of government is immune from inflicting taxes on its people. If something is popular or better still necessary, then the government will try and find a way to tax it. What’s worse most of us pay taxes on already taxed income.

In just over two weeks the British government is going to impose what has become popularly known as the Bedroom Tax. It will affect low income families and individuals who currently receive financial support from the state. Should they have more bedrooms in their home than is required for the number of people living in it, then they will face a reduction in their state provided income. This is a plan by the government both to help bring spending into control but also as a way to free up housing stock and house people in appropriately sized homes to allow young families get a roof over their heads.

Opinion in the U.K. is divided between it being seen as part of a wider ethnic cleansing of the poor from expensive neighbourhoods to those who think such measures are nowhere near enough.

Already prominent politicians are urging that bedroom doors be bricked up or dividing walls demolished as a cunning way to avoid the scheme. Already the bedroom tax is being compared to some of the other stranger taxes people have endured over the years.

Unfair taxes go back to the dawn of time, in Ancient Egypt, cooking oil was taxed. To make it worse Egyptians had to buy their taxed cooking oil from the Pharaoh’s monopoly. They were even prohibited from reusing previously purchased oil by state officials who would ensure they disposed of their existing oils.

In Ancient Rome, it was not uncommon for slave owners to free their slaves after a certain number of years of work or the payment of a certain fee. Slaves could pay that fee because many of them had the opportunity to work in several places, and thus could earn the money used to obtain their freedom. However as we all know, freedom brings responsibility and the Roman government required the newly freed slave to pay a tax on his or her freedom.

Being at the forefront of having a centralised and effective state, we in England have suffered our fair share of strange taxes. When we were a republic for a few years, Oliver Cromwell placed a tax on Royalists, who were his political opponents and could take one tenth of their property. He then used that money to fund his activities that were aimed against the Royalists.

Obviously it can get pretty cold in England and as soon as it was feasible, people started having fireplaces in as many rooms as possible not just to keep warm but as status symbols, the equivalent of having flat screen TV’s in every room. In 1660, the state placed a tax on fireplaces. The tax led to people covering their fireplaces with bricks to conceal them and avoid paying the tax. It was repealed in 1689.

Window tax, or glass tax, was introduced in England (and subsequently the whole of Britain) in 1696 during the reign of King William III. Eventually repealed in 1851, it was initially brought in as a way to tax people relative to their wealth while circumventing the vehemently opposed income tax.

Evidence of the the window tax can still be seen in Britain today. Many of the period’s surviving buildings feature bricked-up windows spaces, a common practice used to alleviate the tax burden on middle-class families. The phrase ‘day-light robbery’ is likely to come from these times and is still used in situations where something is impossibly unfair.

If taxes on windows wasn’t bad enough, in the 1700’s, the British government placed a tax on bricks. Builders soon realized that they could use bigger bricks and so fewer bricks to pay less tax. Inevitably the government eventually caught on and placed a larger tax on bigger bricks. Brick taxes were finally repealed in 1850.

In 1712 a tax was introduced on printed wallpaper and ignoring this tax was punishable by death! Builders avoided the tax by hanging plain wallpaper and then painting patterns on the walls.

In 1789, we suffered a tax on candles. People were forbidden from making their own candles unless they obtained a licence and then paid taxes on the candles they produced. The tax was repealed in 1831, leading to a the more widespread use of candles just as gas lamps became popular.

We still have a tax on televisions. If you own a television in your home, you must pay an annual fee, formally called a television license, for each television you own. Colour televisions are taxed at a higher rate than black and white televisions. Interestngly enough, if a person is blind an owns a TV in his or her home, he or she still has to pay the tax, but only half of it as they can still enjoy the television by listening to it. Whilst some people don’t like the television licence, it is quite popular as taxes go. This is because the tax is ring-fenced for the BBC which in theory can then produce expensive quality shows and shows that are not catering to popular and poor taste programmes. It also means we escape having TV commercials on all the BBC channels.

Stupid taxes are popular in the USA too. Wisconsin is one of the few states that levies a tax on internet access. When dial-up was a popular method of getting online, there was double taxation occurring because phone calls were also taxed.

Bizarrely, the state of Tennessee in 2005 began requiring drug dealers to anonymously pay taxes on any illegal substances they sold.

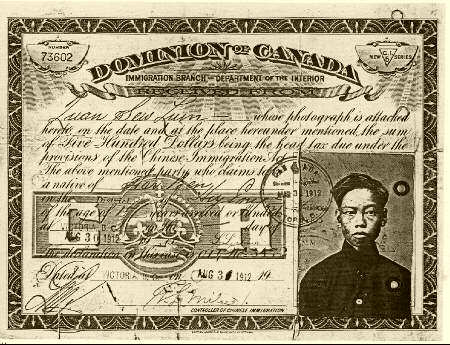

In 1885 Canada created the Chinese Head Tax, which taxed the entry of Chinese immigrants into Canada. The tax lasted until 1923 when a law was passed banning Chinese people from entering Canada altogether with a few exceptions.

Peter the Great’s was one of the greatest Tsars of Russia. He is said to have special advisors who thought up strange taxes such as on drinking water and beehives. His most absurd proposal of all became law in 1705 and levied taxes on men for the great sin of growing beards. He did this because facial hair was very popular in Russia and he wanted his subjects to get with it a little more and imitate the clean shaved look of Western Europeans. This is just one of the first taxes that were put in place to get people to change their behaviour. Many countries now including the UK put extra taxes on objects such as cigarettes, vehicle fuel and junk food in what the state would say were efforts to improve the lives and environment of the people.

In Germany, bribery is a legal, deductible expense for private businesses as far as the Bundestag is concerned though there has been much talk or removing this option as many ordinary Germans are appalled that this could take place in their businesses and government. Not many people actually take advantage of this tax break however as the tax forms require the naming of the person who is asking for bribes which kind of defeats the whole purpose.

Just last year the government got itself in an awful mess as sometimes taxes can have totally unexpected results. In the U.K. we have VAT, similar to a Sales Tax which is applied to luxury foods. So biscuits don’t have VAT but cakes do as does hot foods but not foods that are sold hot as a side effect of their production such as fresh bread. Last year the government initiated the awful “Pasty Tax”.

The government imposed VAT on the sale of hot takeaway baked snacks such as cornish pasties and sausage rolls. This caused uproar and caused panic in the government when they were labelled as being out of touch taxing popular foods which they never ate themselves. Chancellor George Osborne (Finance Minister) was forced to admit he couldn’t remember having this popular snack. Prime Minister David always trying to show he isn’t as posh as he actually is told the media that he enjoyed Cornish Pasties and that he last one from a city centre train station store. Things went down hill when it was revealed the store in question has closed years earlier and when opposition Labour leaders were filmed posing eating Greggs pasties and sausage rolls then it was only a matter of time before this stupid tax law was dropped just a few months later.

What governments and people often forget that they the government are representing us the people both those who voted and didn’t vote for them. Though we are reliant on government services like roads, police and education, they are also reliant on not taking the pee out of the people. Sure we pay a lot of tax on our fuel but as much as we need to get to work to do our jobs and get paid, the state also needs us to go to work and do our jobs.

The chart above shows how much tax people in the U.K paid on their vehicle fuel in 2011, it is now considerably higher. From £1.28 pence per litre nearly 60 pence is Fuel Duty and a further 21 pence is VAT. So we are paying tax on fuel twice from our already taxed income. For readers in the United States there are 5 litres in a gallon so in 2011 we were paying about $10 per gallon and 60% of this was tax.

A poll tax (or head tax/capitation tax) is a fixed rate tax levied on individuals with no reference to income or property. Taxes of this type have been used since ancient times since their indiscriminate nature makes them easy to implement. This indiscriminate nature, however, also makes them hugely unpopular.

Probably the the most controversial and divisive implementations of a Poll Tax occurred in the UK during the 1980s under Margaret Thatcher’s government. If you ever wonder what was it that removed Margaret Thatcher from the global scene, it wasn’t Trade Unions, Unemployment, Communism or even the year long Mining Strike that got rid of the Iron Lady but it was the Poll Tax. The effect of shifting the tax burden from the wealthy to the poor created a huge public backlash, resulting in mass protests, riots and the downfall of the Prime Minister.

I think you did a great job. Bravo for still writing under the circumstances.

As for the Poll Tax, in Wales, I think it was the Mining Strike that did it. Thatcher closed down all the Welsh mines and many major industries.

LikeLike

Thank-you. Lovely Mrs T. I think she is a great example of a world leader being more popular overseas than she was at home.

LikeLike

Thank you once again for your research and well written post. Here it is the same in the USA with the wealthy having many, many loopholes to avoid paying taxes. The poor and the middle class are carrying the tax burden for everyone while the government tries to whittle away our rights. Not a happy picture.

LikeLike

I’m glad that you like my posts.I agree with you. I know in the USA that far too much power is wielded by powerful corporations who really push fair democracy to the limits.

I am sure that Founding Fathers over there and our own far-sighted leaders over here would be appalled at the state we are in.

With the era of the internet I wonder if the only way to improve things is for every person to be able to vote on every issue electronically and just keep parliamentarians and Congressmen as figure-heads to vote on really core issues.

In my own “village” hundreds of new homes are being built on protected land and parks against the protests of the majority of locals and yet elected representatives at both local, regional and national level seem to ignore the people whilst pretending to listen and protest on our behalf. Yet so many corporations seem to have these same politicians as consultants.

I remember reading once that people are only free every 4 or 5 years when we can vote but in reality our votes count for little when each party is largely funded by the same rich individuals or corporations.

It makes me mad 🙂

LikeLike

Is that why revolutions occur? Because change becomes impossible within the system. Those in power protecting themselves so that they can maintain power.???

LikeLike

I think so. Modern democracy in both our countries and others like France started due to this. Even many revolutions in the modern day such as Egypt had similar causes. Let’s hope we can recover without that but sometimes I have my doubts.

LikeLike

Outstanding article. I also find it strange how fast the taxes have been expanding and increasing in the United States, considering the history of the United States. Americans revolted against King George III over taxes abd then declared themselves an independent nation. The first rebellions in the United States were the citizens rebelling against taxes they did not like (like the Whiskey rebellion).

I am sorry to hear about your loss and I will keep you and your family in my prayers.

LikeLike

Thank-you.

It seems that taxes are getting more and more out of control in every country. Just as every state seems to be taking more control of the lives of citizens, so they want to increase the taxes on every aspect of our lives.

Governments, forget it is us who go to work and it is our money we earn. Rather than tax us so much, maybe they can stop trying to control our lives more and more each year.

As individuals we all should try and live within our means, so do corporations so why shouldn’t states do too.

Thank-you for your prayers, it means a lot to me.

LikeLike

I agree with you 100%.

LikeLike

Fantastic article, thanks so much for writing this. The history of the taxes in the UK is very curious, and it raises lots of questions about the relationship between the state and its subjects, and how this bears on people’s engagement with politics. When I lived in London some years ago, I always thought that TV license which applied to every tv in the house was a total rort (as we say in Australia), and I was sure that our landlord just pocketed that money himself!

LikeLike

Thank-you. That’s very funny. I can imagine foreign visitors thinking that of landlords.

The TV licence does sound bad and no-one likes paying £140 or so each year but I think in a way it is worth it as it is great not to see adverts on TV and to have more in depth TV shows.

I wonder what things would be like if the taxes we paid were guaranteed to go on what we wanted. We would probably all have really good hospitals and trains and awful everything else!

LikeLike

A fabulous and fascinating piece. I’m so sorry you’ve faced such difficult losses these past two weeks. You’re in my thoughts. With a little luck, the loss of your job will make you ready and available for something better soon.

LikeLike

I’m glad you liked my article. Thank-you for your kind words. I’m sorry it took so long to reply but you can guess how things are. Thank-you.

LikeLike

As someone from the US by birth who has lived nearly everywhere – I find their persistence fascinating. They lost the colonies due to such practices… when I lived there last there was a lot of talk about the bloating of the Monarchy, expense of keeping it up, switching parties – even our conservative party here realized that we cannot tax those with the least while giving a free pass to those who have the most and were forced to give into taxation on the upper income brackets (they don’t nickel and dime you here so much as just take it from your income before you get it in the first place). Extremism seldom works. Idiocy never does.

LikeLike

Yes I agree. It makes no sense to inflict these taxes at a time when tax cuts have been given to multi-millionaires.

There are always features on the news on a certain day of the year when normal working people have paid their taxes and the rest of the years salary actually belongs to them.

I am almost certain that last year it was in Mid-May which means everyone ordinary person who goes to work in the U.K. works for nearly 5 months before they start earning money for themselves.

LikeLike

Very informative and sorry about your mum…

LikeLike

Thank-you.

LikeLike

Sorry for your deeply felt loss and to hear March has been a less than perfect month for you.

In any advanced society taxation is a necessary evil, as we never voluntarily or equitably give enough to those in dire need. Of course, the trick is in developing an equitable taxation system that is both relatively free from abuse by the wealthy or the poor while at the same time of sufficient size as to provide common necessities to the needy. I’m not aware of any society where this has occurred yet – although some places are probably better than others 🙂

Here in Australia the current tax whinge is about taxing superannuation accounts. The current system gives tax breaks (paid for by all taxpayers) whereby the top 15% of income earners get 50% of the tax breaks (around some $10 billion this year alone) The stupidity of giving so much taxpayer funds to those who will never live on a government pension alone, from a system that was designed to save the taxpayer from having to pay those pensions in the first place seems to have been missed by almost all our population! The ‘poor’ are effectively paying the rich so, as always, the rich get richer while the poor get poorer in comparison.

WE have the tax on a duty for petrol here, but ours is a mere 10% gst(=VAT).

The best rort i have heard of was a guy claimed, taking his case to the Aussie high court and being awarded approval to, have the ATO count $220,000 he claims was stolen in a drug deal that went wrong as a legitimate tax deduction against his drug-dealing income ( estimated to be $445,000 in 1994-95). He did get a 12 year sentence for heroin possesion though 😉

LikeLike

Thanks Bob for your kind words.

It’s comforting to know that even in Australia you have similarly bad tax laws.

That is a great story about the drug guy. That is fascinating that you can awarded tax incentives for illegal activities. I know there are some states in the USA where this is standard practice. I can’t imagine any dealers being stupid enough to do it though 🙂

LikeLike

I thought this post wasvery interesting, especially since here in the US I haven’t heard much about the Bedroom Tax. (I do enjoy the BBC shows we see though.:)

I’m sorry again for the loss of your mother.

LikeLike

Thanks again Merril. I do think that as taxes go, the one that gives us the BBC is probably one of the best in the world.

LikeLike

I heard about the “bedroom tax” on the radio on April 1 and my first thought was that it was the April Fools joke.

LikeLike